From: Rep. Laurie Jinkins <RepLaurieJinkins@updates.leg.wa.gov>

Date: Thu, Apr 11, 2019 at 2:01 PM

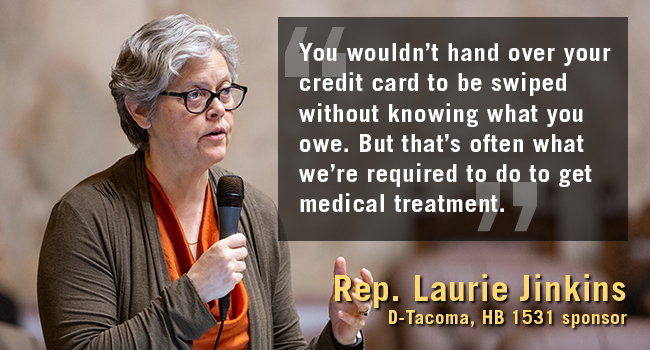

Subject: Protecting consumers: Debt collection bills close to finish line

To: <maureenhowardconsulting@gmail.com>

|

|

||||

3320 S. 8th Street

Tacoma, WA 98405